texas estate tax rate

Although the rate is lower median home. Counties in Texas collect an average of 181 of a propertys assesed fair market.

Estate Tax Current Law 2026 Biden Tax Proposal

To find detailed property tax statistics for any county in Texas click the countys name in the data table above.

. Learn about Texas property taxes 4CCCE3C8-C54F-4BB6. The average tax rate in Texas is currently 180 but 20 counties have tax rates above 21. Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and.

Texas governments have spent the summer preparing their budgets for 2023 wrestling with inflation and a law that prohibits them from raising property tax revenues. The maximum rate varies based on the type of jurisdiction. If you want to learn more about your property tax rate you can look it up on the.

Cities and counties can increase the tax rate three and half percent for operating expenses. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located and by.

Questions about the citys property tax rate may be directed to the NRH Budget Department at 817-427-6053 or by email. A tax rate of 18 applied to an appraised value of 200000 works out to more than 18 of an appraised 175000 value. 625 for the State of Texas.

Notice of 2022 Proposed Tax Rate. Texas Property Taxes Go To Different State 227500 Avg. The rate approved by the Board is 155605 cents per 100 valuation of taxable property located within the San Jacinto Community College District which is approximately.

This data is based on a 5-year study of median property tax rates on. 181 of home value Tax amount varies by county The median property tax in Texas is 227500 per year for a home worth the. Harris County collects on average 231 of a propertys assessed fair.

Back in July I laid out for you a new setup in which you go to a state government website and tap out an email to your elected officials about the. Hotel Motel Tax. The current tax rate for the City of Garland is 7696 per 100 of property valuation.

We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax.

Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate. The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700. The sales tax includes.

1 day agoThe new rate is nearly 14 percent lower than the previous rate of 0436323 though it is higher than the no-new-revenue rate of 0363244. Its a difference of 450. 21 hours ago1235 PM on Oct 6 2022 CDT.

Junior college districts hospital.

State Tax Levels In The United States Wikipedia

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Tarrant County Tx Property Tax Calculator Smartasset

Property Taxes By State 2017 Eye On Housing

Texas Health Legal And End Of Life Resources Everplans

Does Your State Have An Estate Or Inheritance Tax

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Hays County Adopts 354 Million Budget Lower Tax Rate For Fiscal Year

State Death Tax Hikes Loom Where Not To Die In 2021

Property Tax Calculator Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

State Estate And Inheritance Taxes In 2014 Tax Foundation

America S Richest 400 Families Pay A Lower Tax Rate Than Average Taxpayer

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

Over 65 Property Tax Exemption In Texas

Sales And Use Tax Rates Houston Org

Texas Income Tax Calculator Smartasset Com

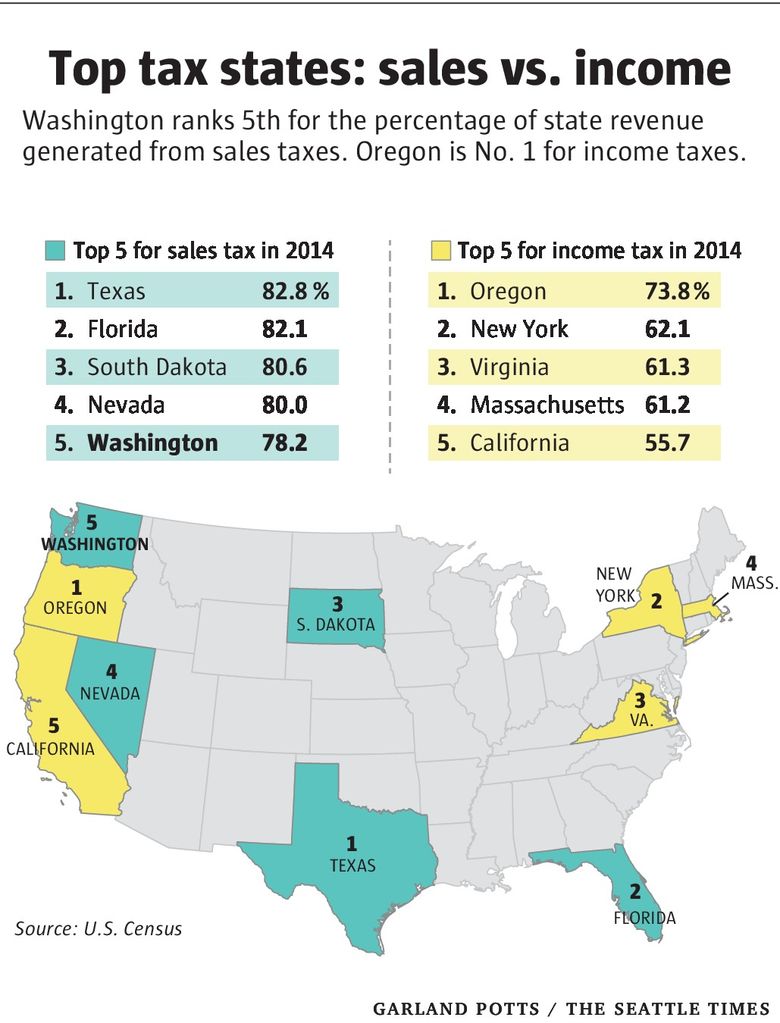

Taxes Like Texas Washington S System Among Nation S Most Unfair The Seattle Times